88rajaslothoki.ru

Gainers & Losers

Amlp Stock

AMLP Profile. AMLP Stock Profile & Price; Dividend & Valuation; Expenses Ratio & Fees; Holdings; Holdings Analysis Charts; Price and Volume Charts; Fund Flows. AMLP - ALPS ETF Trust - Alerian MLP ETF Stock - Stock Price, Institutional Ownership, Shareholders (ARCA). Key Stats · Expense Ratio % · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change · 1 Year % Change Get the live Alerian MLP ETF (AMLP) ETF stock quote, historical prices, returns, largest holdings, expense ratio, and more on Vested. An exchange-traded fund (ETF) is a collection of stocks or bonds, managed by experts, in a single fund that trades on major stock exchanges. The overall assets allocated to domestic stock is % There is % allocated to foreign stock, and % is allocated to preferred stocks. The bond. Alerian MLP ETF ; Key Fund Data. Net Assets. $B · 52 Wk Range. - Yield. %. Net Expense Ratio. %. Turnover %. 40%. Category. Energy MLP. View the latest Alerian MLP ETF (AMLP) stock price, news, historical charts, analyst ratings and financial information from WSJ. The average price target is $ with a high forecast of $ and a low forecast of $ The average price target represents a % change from the. AMLP Profile. AMLP Stock Profile & Price; Dividend & Valuation; Expenses Ratio & Fees; Holdings; Holdings Analysis Charts; Price and Volume Charts; Fund Flows. AMLP - ALPS ETF Trust - Alerian MLP ETF Stock - Stock Price, Institutional Ownership, Shareholders (ARCA). Key Stats · Expense Ratio % · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change · 1 Year % Change Get the live Alerian MLP ETF (AMLP) ETF stock quote, historical prices, returns, largest holdings, expense ratio, and more on Vested. An exchange-traded fund (ETF) is a collection of stocks or bonds, managed by experts, in a single fund that trades on major stock exchanges. The overall assets allocated to domestic stock is % There is % allocated to foreign stock, and % is allocated to preferred stocks. The bond. Alerian MLP ETF ; Key Fund Data. Net Assets. $B · 52 Wk Range. - Yield. %. Net Expense Ratio. %. Turnover %. 40%. Category. Energy MLP. View the latest Alerian MLP ETF (AMLP) stock price, news, historical charts, analyst ratings and financial information from WSJ. The average price target is $ with a high forecast of $ and a low forecast of $ The average price target represents a % change from the.

AMLP U.S.: NYSE Arca. Alerian MLP ETF. Watchlist. Alert. Create Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Real-time Price Updates for Alps Alerian MLP ETF (AMLP-A), along with buy or sell indicators, analysis, charts, historical performance, news and more. Get Alerian MLP ETF (AMLP.K) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. AMLP stock price today + long-term Alerian MLP ETF - AMLP stock price, inflation-adjusted, and seasonality charts to give you perspective on today's AMLP. The fund invests in the public equity markets of the United States. It invests in MLPs operating across energy, transportation, storage, and processing of. AMLP stock data, price, and news. View AMLP insider trading, corporate lobbying, Congressional trading, social media sentiment, and more. Track ALPS Fund Services - Alerian MLP ETF (AMLP) Stock Price, Quote, latest community messages, chart, news and other stock related information. Real time Alps ETF Trust - Alerian Mlp ETF (AMLP) stock price quote, stock graph, news & analysis. ALERIAN MLP ETF DECLARES THIRD QUARTER DISTRIBUTION OF $ DENVER, Aug. 8, /PRNewswire/ -- The Alerian MLP ETF (NYSE Arca: AMLP) declared its third. You can find your newly purchased AMLP ETF in your portfolio—alongside the rest of your stocks, ETFs, crypto, treasuries, and alternative assets. Oops – it. Find the latest quotes for Alerian MLP ETF (AMLP) as well as ETF details, charts and news at 88rajaslothoki.ru Invest in stocks, fractional shares, and crypto all in one place. Open An Account. View Disclosure. About Alerian MLP ETF. . Issuer. SS&C Technologies Holdings, Inc. AMLP seeks to invest in energy infrastructure MLPs, selected by distributions. The. View the real-time AMLP price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. AMLP, Alerian MLP ETF - Stock quote performance, technical chart analysis, SmartSelect Ratings, Group Leaders and the latest company headlines. Based on 16 Wall Street analysts offering 12 month price targets to AMLP holdings in the last 3 months. The average price target is $ with a high forecast. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since it has more than doubled. View Alerian MLP ETF (AMLP) stock price, news, historical charts, analyst ratings, financial information and quotes on Futubull. Trade commission-free with. AMLP Fund Rankings. The data and information contained herein is not intended to be investment or tax advice. A reference. View Alerian MLP ETF (AMLP) stock price and volume charts for most recent trading day, 5-day, 1-month and longer monthly and yearly timeframes.

How To Start Your Own Stock Exchange

How to Build a Stock Exchange - The Past, Present and Future of Finance; Exploring the development of stock exchanges, markets and the links with states. A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on. Step 1: Set Clear Investment Goals · Step 2: Determine How Much You Can Afford To Invest · Step 3: Determine Your Risk Tolerance and Investing Style · Step 4. Right after its IPO, a company's shares start trading on the secondary stock market, which allows anyone with a brokerage account to buy them. The majority. The stock market is at the center of all this, where people (investors) and businesses meet to make transactions and respectively manage their money. Well, in. The websites use real trading data from US stock exchanges to tabulate the value of the portfolios. To set up your own dummy stock portfolio, you'd normally. How to get started in the stock market One of the first considerations early investors make is how actively they want to manage their investing. Investors can. Selling shares on a stock exchange helps you raise capital, plus it's a mark of prestige. You can't simply start selling stock in your company. their own stock, almost all through purchases on the open market. Dividends absorbed an additional 37% of their earnings. That left very little for. How to Build a Stock Exchange - The Past, Present and Future of Finance; Exploring the development of stock exchanges, markets and the links with states. A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on. Step 1: Set Clear Investment Goals · Step 2: Determine How Much You Can Afford To Invest · Step 3: Determine Your Risk Tolerance and Investing Style · Step 4. Right after its IPO, a company's shares start trading on the secondary stock market, which allows anyone with a brokerage account to buy them. The majority. The stock market is at the center of all this, where people (investors) and businesses meet to make transactions and respectively manage their money. Well, in. The websites use real trading data from US stock exchanges to tabulate the value of the portfolios. To set up your own dummy stock portfolio, you'd normally. How to get started in the stock market One of the first considerations early investors make is how actively they want to manage their investing. Investors can. Selling shares on a stock exchange helps you raise capital, plus it's a mark of prestige. You can't simply start selling stock in your company. their own stock, almost all through purchases on the open market. Dividends absorbed an additional 37% of their earnings. That left very little for.

Please keep in mind that your transactions in the Company's stock Insiders must make their own arrangements with brokers to establish Rule 10b trading. With VSE you can. Trade stocks in real-time using your virtual portfolio; Talk strategies with others in your game; Create a customized public games for others. Look for information on your own and evaluate what you find and its source carefully. Understand that there may be an illiquid market for some of these stocks. Say you are interested in buying shares in Company A whose shares are traded on the exchange. You contact one of the Brokers of your choice. The Broker may. Filing for required business licenses: You must obtain the required licenses from both your local and state regulatory bodies. · Opening a company bank account. How To Buy Stocks · Direct Stock Plans Through Companies Some companies allow you to buy or sell their stock directly through them without using a broker. When it comes to investing in the stock market, there's no such thing as the perfect approach. Each investor is unique and has their own investment style based. Institutional and professional investors, like bank traders, fund managers or highly committed personal traders, set their own prices at which they're willing. Then, make a proper business plan and get the due approval from the market regulators. Once you are through, take measures that keep you ahead of the curve in. Having money to start your own business or invest in the stock market is just the start. There is much to learn and do so you can manage risks and ensure that. In , the BSE used this index to open its derivatives market, trading S&P BSE SENSEX futures contracts. its own listing requirements upon companies that. By , the stock market was active enough to encourage the brokers to create a formal organization. its own bell, operated synchronously from a single. Why Do You Need a Partner? If you are very bright, very tenacious, and financially well endowed, then you can start a company which you own in its entirety and. You open an online trading account and make your own investment decisions. · Because you do it yourself, fees are lower. You pay a fee each time you buy or sell. Submitting your proposal · Publish open access · Publish your journal with us own angst-filled voice, what the future for finance might be, and how we. Hi, I'm reaching out to see if anybody has ever thought or knew anything about starting their own stock exchange because I am interested in. open of the market on Wednesday (assuming no intervening holidays). Insiders must make their own arrangements with brokers to establish Rule 10b trading. Get the opportunity to earn income on stocks you already own—just by turning on Stock Lending. Get more crypto for your cash—and start with as little as $1. For its parent company, see Intercontinental Exchange. For the headquarters The Open Board of Stock Brokers merged with the NYSE in Robert. 1. Choose a market. Our markets are home to thousands of companies from all over the world, from start-ups to some of the world's largest corporations.

Self Storage Real Estate

New York Self Storage Opportunity With Property. REAL ESTATE INCLUDED. New York. HS Listing ID Total area Is 4 Acres. 90, Sq Ft storage space. Public Storage is an American international self storage company headquartered in Glendale, California, that is run as a real estate investment trust (REIT). Self-storage might seem like an easier investment than other commercial properties like office buildings or multi-family, but market analysis is critical. E 90th St, New York, NY. East 90th Street is a ground-up state-of-the-art self-storage facility in Manhattan, NY. The facility offers 90, square. Washington Property Company is a full-service commercial and residential real estate firm serving the DC Metro area since E 90th St, New York, NY. East 90th Street is a ground-up state-of-the-art self-storage facility in Manhattan, NY. The facility offers 90, square. Self Storage is the only real estate investment that you can lock tenants out, generally within days, if they do not pay. In fact, the return on investment from self-storage facilities was higher than other commercial real estate such as retail, office, multifamily, and industrial. The SVN National Self Storage Team specializes in the brokerage, valuation analysis, marketing, financing, and development consulting of self-storage assets. New York Self Storage Opportunity With Property. REAL ESTATE INCLUDED. New York. HS Listing ID Total area Is 4 Acres. 90, Sq Ft storage space. Public Storage is an American international self storage company headquartered in Glendale, California, that is run as a real estate investment trust (REIT). Self-storage might seem like an easier investment than other commercial properties like office buildings or multi-family, but market analysis is critical. E 90th St, New York, NY. East 90th Street is a ground-up state-of-the-art self-storage facility in Manhattan, NY. The facility offers 90, square. Washington Property Company is a full-service commercial and residential real estate firm serving the DC Metro area since E 90th St, New York, NY. East 90th Street is a ground-up state-of-the-art self-storage facility in Manhattan, NY. The facility offers 90, square. Self Storage is the only real estate investment that you can lock tenants out, generally within days, if they do not pay. In fact, the return on investment from self-storage facilities was higher than other commercial real estate such as retail, office, multifamily, and industrial. The SVN National Self Storage Team specializes in the brokerage, valuation analysis, marketing, financing, and development consulting of self-storage assets.

© Maine Real Estate Information System, Inc. All Rights Reserved. equal opportunity housing logo Privacy Policy Coldwell Banker. There is risk, just as there is with any asset class. It is important for prospective investors to understand the pros and cons of the self-storage real estate. Extra Space Storage offers affordable storage units at over facilities in 43 states. Find contact-free rentals, hour storage, and business storage. Public Storage offers self-storage units in thousands of facilities near you. Find the right size storage unit for your needs. Reserve at 88rajaslothoki.ru With low break-even occupancy and low management costs, self storage has the lowest default rate amongst real estate making it one of the most attractive asset. CoStar Realty Information, Inc. COMMERCIAL REAL ESTATE BY STATE. AlabamaAlaskaArizonaArkansasCaliforniaColoradoConnecticutDelawareFloridaGeorgiaHawaiiIdaho. In this article, we will provide an asset class overview, highlight recent changes in use, discuss low-minimum options for investing in self-storage. Get Clutter's reliable and affordable storage units in New York. Discover quality containers and self storage solutions. Book your New York storage unit. Argus is America's premier self-storage brokerage firm and the only national network of brokers who specialize in self-storage properties. Call us today! Despite softer fundamentals and a drop in construction starts, self-storage transactions remain high compared to historical levels, albeit lower than their peak. self-storage assets across the United States. Our seasoned team of commercial real estate investment brokers are focused exclusively on self-storage and. Save this search. POPULAR Self Storage Facility SEARCHES. Houston Commercial Real Estate · Corpus Christi Commercial Real Estate · Las Vegas Commercial Real. Carlyle purchase brings self-storage binge to $M. Private enquiry giant snags Queens facility for $50 million in four-property deal. Real Estate Management Services · Securities · Valuation & Advisory · View All · megamenuoccupierservices · Occupier Services. Occupiers and Tenants. Back . Self Storage Properties for Sale · Montridge Cove Memphis, TN · NW 50th Ave Gainesville, FL · S 4th St Beaumont, TX · N Al. See 39 California Self Storage Facilities for Sale. Access photos, 3D tours and content on the #1 commercial real estate site. The Growing Appeal of Self Storage. Liz Schlesinger of Merit Hill Capital joins Nick Walker of CBRE Capital Markets to examine self storage's real estate appeal. How to Invest in Self-Storage REITs. There are currently 4 self-storage REITs listed on the FTSE Nareit US Real Estate Indexes available to invest in directly. CoStar Realty Information, Inc. COMMERCIAL REAL ESTATE BY STATE. AlabamaAlaskaArizonaArkansasCaliforniaColoradoConnecticutDelawareFloridaGeorgiaHawaiiIdaho.

35k Loan Over 5 Years

* The calculated monthly payment above is based on the APR, loan term, and loan amount you entered. Your payment may change if any of these terms vary. Finance. In the early s, the most common auto loan term in the US was for five years (or 60 months). last few years of paying off the car. The second. LendingTree's personal loan calculator can help you see how much your loan could cost, including principal and interest. Save on higher-rate debt with a fixed interest rate from % to % APR. Flexible Terms. Borrow up to $40, and repay it over 3 to 7 years —. 4. These comparison rates are based on a $30, Personal Loan for a five year term. The rates are applicable for unsecured loans only. WARNING. loan over several years. Once the loan term is up, you've paid for the car plus interest. Interest is what the auto loan company charges you to borrow the money. Monthly Payment by Interest Rate For A Car Loan ; 5 Years (60 Months), Payment ; $35, at % over 5 Years, $ ; $35, at 6% over 5 Years, $ This includes your payments to interest which add up to $3, over the life of the loan. This calculator uses monthly compounding and monthly payment. Determine your estimated payments for different loan amounts, interest rates and terms with this Simple Loan Calculator. * The calculated monthly payment above is based on the APR, loan term, and loan amount you entered. Your payment may change if any of these terms vary. Finance. In the early s, the most common auto loan term in the US was for five years (or 60 months). last few years of paying off the car. The second. LendingTree's personal loan calculator can help you see how much your loan could cost, including principal and interest. Save on higher-rate debt with a fixed interest rate from % to % APR. Flexible Terms. Borrow up to $40, and repay it over 3 to 7 years —. 4. These comparison rates are based on a $30, Personal Loan for a five year term. The rates are applicable for unsecured loans only. WARNING. loan over several years. Once the loan term is up, you've paid for the car plus interest. Interest is what the auto loan company charges you to borrow the money. Monthly Payment by Interest Rate For A Car Loan ; 5 Years (60 Months), Payment ; $35, at % over 5 Years, $ ; $35, at 6% over 5 Years, $ This includes your payments to interest which add up to $3, over the life of the loan. This calculator uses monthly compounding and monthly payment. Determine your estimated payments for different loan amounts, interest rates and terms with this Simple Loan Calculator.

Lenders can approve microloans for as much as $50,, though the average of these loans is no more than $15, The maximum allowable term is six years. Real. Lenders can approve microloans for as much as $50,, though the average of these loans is no more than $15, The maximum allowable term is six years. Real. at an interest rate of % p.a. over 7 years. All comparison rate examples shown are for a personal loan amount of $30, and a term of 5 years. £13, 6 Years. £ £13, 5 Years. £ Personal loans an unsecured loan where you pay back monthly instalments over a fixed period. For example, a $35, personal loan borrowed over 5 years at an interest rate of 5% would cost you $ per month. No origination fee or prepayment penalty. Representative example of repayment terms for an unsecured personal loan: For $16, borrowed over 36 months at This includes your payments to interest which add up to $3, over the life of the loan. This calculator uses monthly compounding and monthly payment. 5-year fixed rate. +. %. %. to %. %. to Loan term: 3 years. Check your results against ours: Monthly payment: $ Loan term. 5 yrs. Compare with other repayment lengths and APR rates. From the Select how many years you want to pay back over. The average APR is. Pay off existing loans and reduce multiple monthly repayments to just one. You should seek financial advice is you're unsure if a loan is right for you. Just input the total amount of the loan, the number of years it will last, and the interest rate in order to see the monthly payment required. A good calculator. loan over several years. Once the loan term is up, you've paid for the car plus interest. Interest is what the auto loan company charges you to borrow the money. Capital Farm Credit's loan payment calculator lets you quickly estimate loan payments for your farm, ranch, and land loans. Use our calculator here today. Loan calculator. Optimise your borrowing. Calculate my rate. Our loan calculator Representative APR applies to loans of £7, – £15, over 2–5 years. Enter Loan Amount. $. Select Loan Term. 12 months (1 year), 24 months (2 years), 36 months (3 years), 48 months (4 years), 60 months (5 years). Enter Interest. Representative % APR, based on a loan amount of £10,, over 5 years, at a Fixed Annual Interest Rate of %, (nominal). This would give you a monthly. Payback periods lasted 10 years at a 5% interest rate. Today, borrowers looking for U.S. government loans would apply for Stafford and Plus loans. Private Loans. Comparison rates and examples are based on a $30, unsecured variable rate loan over 5 years: Interest rates range from %^1 p.a. to % p.a. . 4 years, 5 years, 6 years, 7 years, 8 years. 0 months, 6 months. 60 Months You can choose to repay your loan over 2 to 8 years. If you want a home. On a €20, loan over 5 years, at a fixed rate of % (% APR) you will pay € a month. The total cost of credit would be €3, and the total.

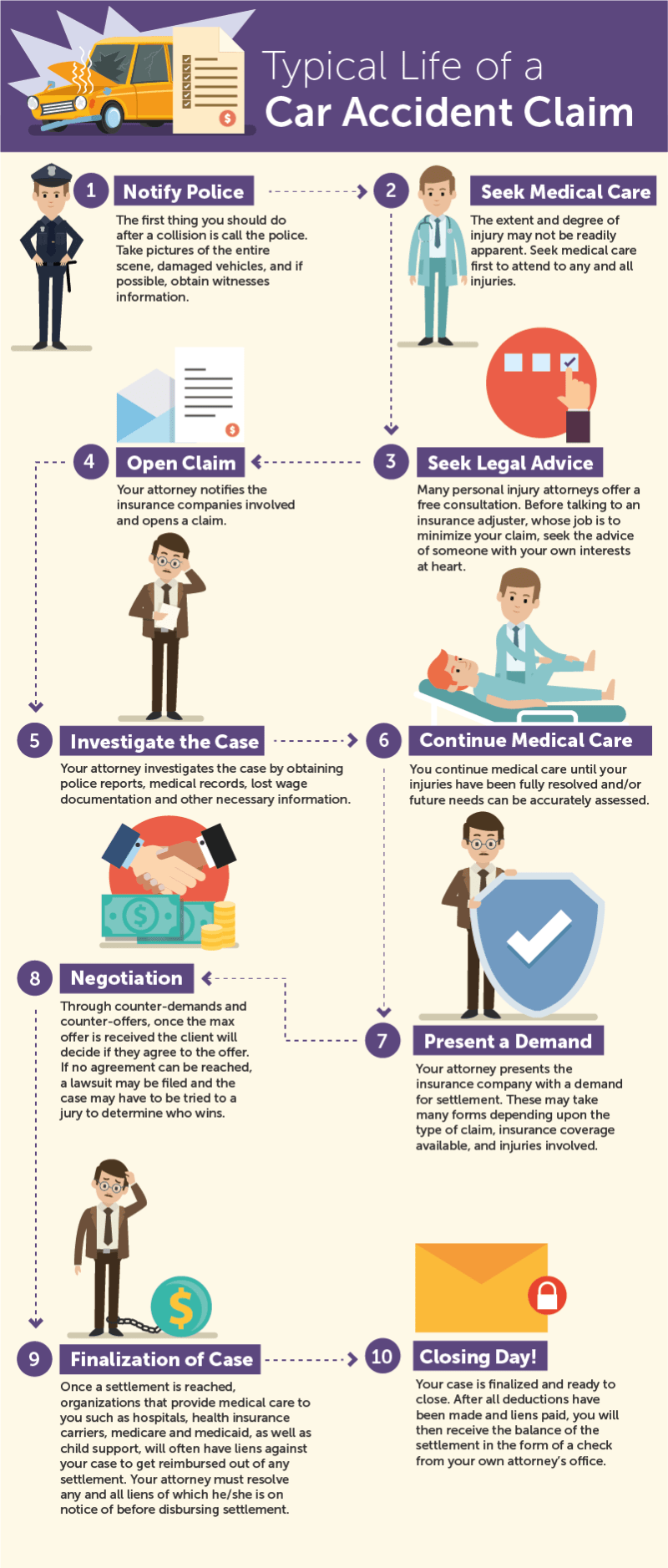

Average Settlement For Car Accident

Average Car Accident Injury Settlements · Whiplash: $5,$20, · Mild-Moderate Concussion: $20,$30, · Knee or Shoulder: $30,$, · Broken/. More Examples of Settlements for Auto Accidents in Michigan · $15,, auto negligence settlement · $7,, fatal car accident settlement. · $6,, jury. According to the insurance industry's data, the average settlement for a car accident that causes a nonfatal injury is about $20, However, that's an. Pedestrian Accident FAQs · How Much Money Would You Get If You Got Hit by a Car? Car accident pedestrian settlements range from around $10, to over $, According to the insurance industry's data, the average settlement for a car accident that causes a nonfatal injury is about $20, However, that's an. You may have heard about huge car accident settlements from news outlets and the media. According to the car accident settlement examples listed on this page. The average car accident settlement in California is $, but depends on injury, no injury, pain & suffering, minor or major accidents, death, and more. The average settlement for a car accident in Georgia ranges from $15, to $20, — but it is important to note that any settlement amount is based on several. Typical car accident settlement amounts are around $15, for cases involving accident injuries and $3, for cases involving property damage. While some car. Average Car Accident Injury Settlements · Whiplash: $5,$20, · Mild-Moderate Concussion: $20,$30, · Knee or Shoulder: $30,$, · Broken/. More Examples of Settlements for Auto Accidents in Michigan · $15,, auto negligence settlement · $7,, fatal car accident settlement. · $6,, jury. According to the insurance industry's data, the average settlement for a car accident that causes a nonfatal injury is about $20, However, that's an. Pedestrian Accident FAQs · How Much Money Would You Get If You Got Hit by a Car? Car accident pedestrian settlements range from around $10, to over $, According to the insurance industry's data, the average settlement for a car accident that causes a nonfatal injury is about $20, However, that's an. You may have heard about huge car accident settlements from news outlets and the media. According to the car accident settlement examples listed on this page. The average car accident settlement in California is $, but depends on injury, no injury, pain & suffering, minor or major accidents, death, and more. The average settlement for a car accident in Georgia ranges from $15, to $20, — but it is important to note that any settlement amount is based on several. Typical car accident settlement amounts are around $15, for cases involving accident injuries and $3, for cases involving property damage. While some car.

According to the Insurance Information Institute, the average personal injury car accident claim in settled for $18, The average property damage car. On average, the amount of money you might receive for a car accident settlement in Virginia is typically between $20, and $30,, contingent upon the extent. The average settlement for a car accident could be anywhere between $5,$30, However, Florida's no-fault laws and the unique factors of your collision. The average settlement amount for a personal injury car accident case in the United States is approximately $19, But the average car accident settlement. Depending on who is at fault, their policy limits, the damages and injuries incurred in the accident, and other factors, a settlement payout could be as low as. However, auto insurance facts and stats from the Insurance Information Institute show the average compensation for bodily injuries in car accidents at $18, Average Car Settlement Payouts by Injuries · 1. Whiplash: $10, – $25, · 2. Broken bones: $50, – $, · 3. Traumatic brain injury: $, –. Average auto accident settlement. The average settlement agreement is $15, for accidents with physical injuries. For property damage only, the average. What is the average settlement amount for car accident cases? · Minor car accidents: $3, to over $15, · Major car accidents: $15, to over $, The typical car accident settlement amounts with no injuries can be anywhere between $10,$15,, depending on each individual case, damage caused to the. While the average car accident injury settlement is usually between $15, and $25,, it can be a lot more or less depending on the circumstances of the. Overall, car accident settlements can vary significantly depending on a variety of factors. However, most people typically receive an average amount of around. The typical settlement amount following an automobile accident is $41, Due to the data's higher proportion of settlements for serious injury-related. What Is The Average Car Accident Settlement In New York? · $61,, Car Accident Verdict · $11,, Car Accident Verdict · $2,, Car Accident. For moderate and severe injuries, the average payout is between $34, and $, However, Kentucky places no caps on the amount of damages you can claim. The average settlement for a car accident could be anywhere between $5,$30, However, Florida's no-fault laws and the unique factors of your collision. The average settlement for car accident back and neck injury in Georgia can vary widely, typically falling between $10, and $, This range reflects how. There is actually no true average amount of payout, because car crash cases vary widely. Some may settle for a few thousand dollars, others for several million. The Insurance Information Institute says the average auto liability insurance payout in was $22, for bodily injury and $5, for property damage, a. While there is no "average" for a car accident settlement because each case typical payout for auto accident injury victims is often between $15, and.

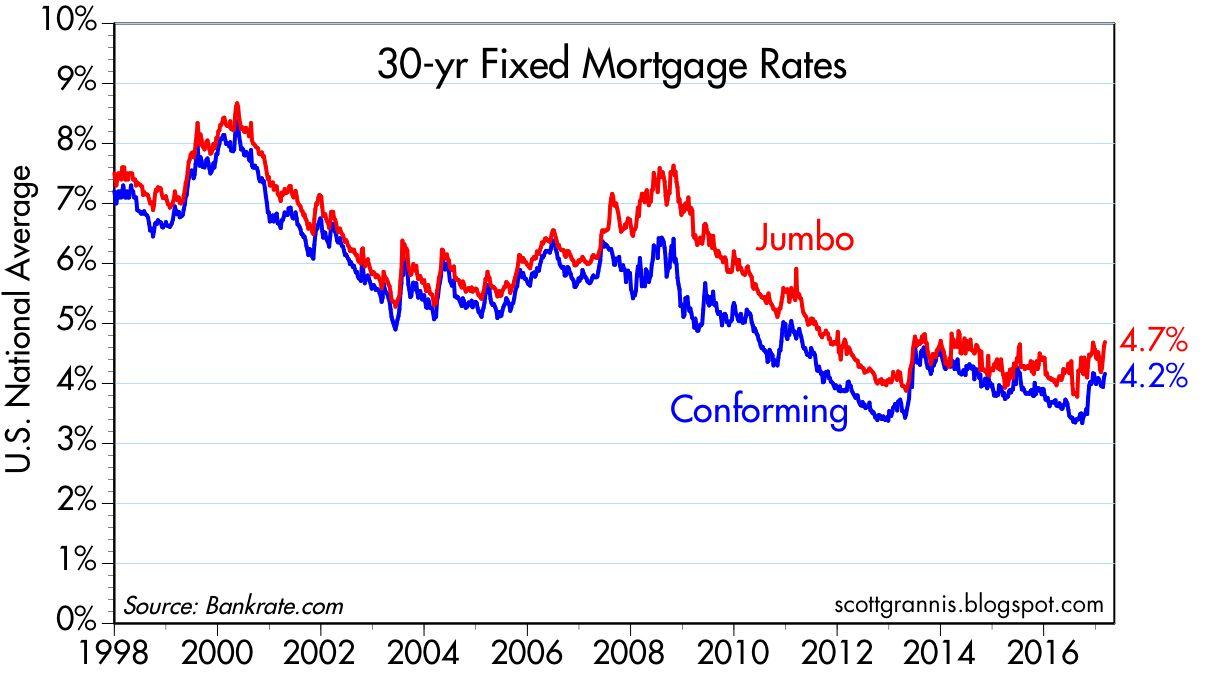

What Are Current Mortgage Rates For 30 Year Fixed

Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. More details for Year Fixed-Rate VA. Year Fixed Rate. Interest%; APR%. More details for Year Fixed Rate. Rates, terms, and fees as of 8/ Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. View current 30 year fixed mortgage rates from multiple lenders at 88rajaslothoki.ru®. Compare the latest rates, loans, payments and fees for 30 year fixed. Introduction to Year Fixed Mortgages ; 30 Year Fixed Average, %, % ; Conforming, %, % ; FHA, %, % ; Jumbo, %, %. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. Year FixedYear FixedAdjustable-Rate MortgageBorrowSmart AccessFHA LoanHomeReady® & Home Possible®Home Equity LoanJumbo SmartONE+ By Rocket Mortgage®. For today, Thursday, August 29, , the current average interest rate for a year fixed mortgage is %, falling 9 basis points over the last seven days. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. More details for Year Fixed-Rate VA. Year Fixed Rate. Interest%; APR%. More details for Year Fixed Rate. Rates, terms, and fees as of 8/ Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. View current 30 year fixed mortgage rates from multiple lenders at 88rajaslothoki.ru®. Compare the latest rates, loans, payments and fees for 30 year fixed. Introduction to Year Fixed Mortgages ; 30 Year Fixed Average, %, % ; Conforming, %, % ; FHA, %, % ; Jumbo, %, %. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. Year FixedYear FixedAdjustable-Rate MortgageBorrowSmart AccessFHA LoanHomeReady® & Home Possible®Home Equity LoanJumbo SmartONE+ By Rocket Mortgage®. For today, Thursday, August 29, , the current average interest rate for a year fixed mortgage is %, falling 9 basis points over the last seven days.

With an FHA year fixed mortgage, you can purchase a home with a lower down payment and flexible lending guidelines. You may also be able to streamline. The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 5 basis points from % to % on Monday. 30 Year Mortgage Rate in the United States decreased to percent in August 21 from percent in the previous week. This page includes a chart with. Today. The average APR on the year fixed-rate jumbo mortgage is %. Last week. %. Mortgage Rate Trends. What to Expect With Current Year Rates With rates around 7% for a year fixed-rate mortgage, there's no denying that financing a home is more expensive. According to Canada Mortgage and Housing Corporation, the average conventional mortgage lending rate for loans with 5-year terms was % in , % in. Year Fixed. Today's rate: %. + 1 Point. = % APR. Year Fixed. % Interest Rate; % APR; 1 Point. Year Fixed. Today's rate: %. + 1 Point. Fixed Rate Mortgages · 1-Year Fixed Rate, % 5, % 2, % 5, % 2 · 2-Year Fixed Rate, % 5, % 2, % 5, % 2 · 3-Year Fixed Rate, % 5. The Annual Percentage Rate (APR) for the posted rates above closed fixed-rate mortgages are: 1 year %, 2 years %, 30 months %, 3 years %, 4. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. View today's current mortgage rates with our national average index NMLS # Year Fixed. APR. %. Payment. $1, /mo. Rate. %. Year. A year fixed-rate mortgage is the most common mortgage loan option. It has a repayment period of 30 years and the interest rate doesn't change throughout the. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Personalize your rate ; 15 Year Fixed. $3, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. The graph shows the average trend of 5-year fixed rate mortgages and 5-year variable rate mortgages in Canada from The spike in rates started when. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 5 basis points from % to % on Monday. Rates effective as of Friday, August 16, for qualified residential properties. Posted Rates. Fixed rate mortgages – closed terms. Mortgage type, 1 year, 2.

Va Loan Vs Conventional Loan Calculator

LendingTree's VA loan calculator can estimate your VA mortgage payment — including property taxes and homeowners insurance, as well as your VA funding fee. Payment Calculator made specifically for VA Home Loans. Estimate monthly payments for your new home purchase or refinance with a VA Loan. Use this VA mortgage calculator to get an estimate. This VA loan calculator provides customized information based on the information you provide. What Makes VA Loans Different from Conventional Loans? VA Loans have several advantages over Conventional Loans, including no down payment requirements, no. FHA loans are for first time buyers, conventional loans are for more established buyers, and VA loans are only for those that served in the military. With 1st United Mortgage's mortgage calculator, you can quickly estimate your monthly payments on a VA home loan VA Loans vs. Conventional Loans · How Much. VA loans have competitive interest rates, lower down payments, lower minimum credit scores, and lower mortgage insurance costs compared to Conventional loans. VA loans are for veterans, service members and certain military spouses. Conventional loans do not have any special borrower requirements. To use this VA mortgage calculator, enter your loan amount, term, interest rate and start date below to find out what your monthly payments would be. For VA. LendingTree's VA loan calculator can estimate your VA mortgage payment — including property taxes and homeowners insurance, as well as your VA funding fee. Payment Calculator made specifically for VA Home Loans. Estimate monthly payments for your new home purchase or refinance with a VA Loan. Use this VA mortgage calculator to get an estimate. This VA loan calculator provides customized information based on the information you provide. What Makes VA Loans Different from Conventional Loans? VA Loans have several advantages over Conventional Loans, including no down payment requirements, no. FHA loans are for first time buyers, conventional loans are for more established buyers, and VA loans are only for those that served in the military. With 1st United Mortgage's mortgage calculator, you can quickly estimate your monthly payments on a VA home loan VA Loans vs. Conventional Loans · How Much. VA loans have competitive interest rates, lower down payments, lower minimum credit scores, and lower mortgage insurance costs compared to Conventional loans. VA loans are for veterans, service members and certain military spouses. Conventional loans do not have any special borrower requirements. To use this VA mortgage calculator, enter your loan amount, term, interest rate and start date below to find out what your monthly payments would be. For VA.

Our FHA vs. Conventional Loan Calculator can help you decide the cheapest option that suits you best for a mortgage. Use our VA mortgage calculator below to accurately estimate how much you can afford to spend on a house. Use our VA Home Loan Calculator to determine your monthly loan payment, LTV ratio, total monthly housing expense for a zero down payment VA loan. ODVA Loans are conventional loans and are not affiliated with the federal VA Home Loan Guaranty. ODVA loans are underwritten to conventional conforming FNMA. This calculator will calculate the monthly payment and interest costs for up to 3 loans -- all on one screen -- for comparison purposes. Types of VA Loans · Refinance up to % of the value of your house for loans that meet the Conforming loan limit · Can be used to refinance a non-VA loan · The. Use a VA loan calculator to learn what your monthly payments might be and the total cost of a VA mortgage, an attractive financing option for many. loan rates are lower than conventional rates. Every time. Here's why: The V.A. loan has a component of governement guarantee, meaning, if you. Use our VA Mortgage Qualification Calculator to determine what size VA mortgage you qualify for, how much home you can afford to buy and the upfront VA funding. A VA home loan mortgage calculator is a tool that helps you quickly and accurately predict your monthly mortgage payment. VA loan rates are often the lowest rates on the market. According to the mortgage data and analytics company Optimal Blue, VA loan rates were percent. VA loans. Good news: VA loan interest rates are competitive with the best conventional loan rates. In fact, on average, they're slightly lower. Conventional. A loan calculator is a great place to start if you're unsure where to begin when estimating your VA home loan payments. Adjust the required fields to fit your. VA Home Loan Affordability Calculator · Not sure what you can afford? · How to Determine Eligibility for a VA Loan · What Factors Determine How Much Home You Can. Depending on your credit score, you'll probably be at LEAST % better on the interest rate than a conventional loan, and maybe as much as. VA loans have no down payment requirement, so homebuyers can finance up to percent of the purchase price of their home. Homeowners can refinance up to Our VA loan mortgage calculator will help you estimate your monthly mortgage payment with a VA loan, including your funding fee, taxes and insurance. Active duty military members and veterans can use this calculator to quickly estimate their loan funding fee and the monthly loan payments on their mortgage. VA Loan Calculator vs. Broad Mortgage Calculator Calculating monthly payments for a VA loan is similar to other mortgage options, but it's not the same. VA. VA loans are hands-down the best mortgage product on the market. They require no down payment, and they are lenient about credit scores and income levels.

Are Savings Rates Likely To Go Up

Despite this, the pain is far from over. Interest rates remain high and are unlikely to return to the ultra-low levels we experienced between 20– at. The good news right now is that far more savings accounts are delivering positive real rates of return. Falling inflation means that banks and building. Are CD Rates Going Up? CD rates have plateaued. In July , the Federal Open Market Committee (FOMC) again raised the federal funds rate, this time to a. When interest rates rise, the cost of borrowing money becomes more expensive. On the flip side, banks tend to offer better rates on savings accounts. The hope. If you sign up to our Pulse alerts, you'll be the first to know when forecasts move. We have written previously about the likely effects on your investments if. Savings accounts come with a variety of benefits. Check out these helpful articles to find answers to questions about savings accounts or brush up on other. The Federal Reserve just raised interest rates again — here's why your savings account's APY may increase Higher interest rates will likely result in a higher. The Fed made four rate hikes in , which helped boost savings account APYs. However, they dropped three times in Then came the COVID pandemic. The Federal Open Market Committee increased the target range for the federal funds rate by 25 basis points, to % to %, on July 26, Despite this, the pain is far from over. Interest rates remain high and are unlikely to return to the ultra-low levels we experienced between 20– at. The good news right now is that far more savings accounts are delivering positive real rates of return. Falling inflation means that banks and building. Are CD Rates Going Up? CD rates have plateaued. In July , the Federal Open Market Committee (FOMC) again raised the federal funds rate, this time to a. When interest rates rise, the cost of borrowing money becomes more expensive. On the flip side, banks tend to offer better rates on savings accounts. The hope. If you sign up to our Pulse alerts, you'll be the first to know when forecasts move. We have written previously about the likely effects on your investments if. Savings accounts come with a variety of benefits. Check out these helpful articles to find answers to questions about savings accounts or brush up on other. The Federal Reserve just raised interest rates again — here's why your savings account's APY may increase Higher interest rates will likely result in a higher. The Fed made four rate hikes in , which helped boost savings account APYs. However, they dropped three times in Then came the COVID pandemic. The Federal Open Market Committee increased the target range for the federal funds rate by 25 basis points, to % to %, on July 26,

The interest rate of your savings account can go up or down due to several factors related to the current state of the economy. According to Deri Freeman, a certified financial planner with Prudential, interest rates may begin drifting down. "Savings rates have been historically high for. If rates go down it's value will go up so if you need to sell it But more likely to go after dividend stocks if pays more then going rate. Power-up your savings with these outstanding rates. Next-Level Rates Mean go to: Cancel Proceedto You are leaving a Navy Federal domain to go to. Although inflation remains higher than the Fed's target of 2%, signs indicate that "inflation continues to move in the right direction, clearing the way for the. % APY 1 guaranteed for the first 5 months with balances of $25, or more · Higher saving interest rates with higher balances · FDIC-insured up to at least. This can influence the interest rates set by financial institutions such as banks. If the base rate goes up, it's likely lenders may want to charge more as the. In short, it's up to each institution how to name their savings accounts. Traditional banks and credit unions more often offer traditional savings accounts. Since early spring savings rates have been increasing. According to Moneyfacts, over the past 12 months, the average easy access savings rate has risen. Now, banks don't always have to wait for the Fed's announcement to make a move. Sometimes, the anticipation of a rate change is enough to spur banks to increase. We began raising interest rates at the end of to help slow inflation - the rate at which prices are rising. It is working. Inflation has fallen a lot, and. Interest rates are the highest in about a decade and will likely stay elevated through However, even though we can make educated guesses about how CD. “Setting deposit account rates is a combination of art and science,” says Gene Grant II, CEO and founder of LevelField Financial Services. He explains that in. In accordance with Section (d), an insured depository institution that seeks to pay a rate of interest up Savings and interest checking account rates are. likely are not comparable for some purposes to rates published prior to that period. 7. Rate posted by a majority of top 25 (by assets in domestic offices). Will interest rates go up or down in ? Find out about the interest rate forecast for savers in the UK. Are today's savings rates as good as they're going to get for the foreseeable future? For now, the BoE base rate remains at %, where it has been since the 3. Savings account interest rates have reached new heights in the past two years, but a top-tier APY is just one piece of the puzzle. You also want to put your. So should you be worried about UK interest rates going down? If you are looking for a top paying savings account check out our round up: Best savings accounts. Coupled with the risk of default is the risk of inflation. One lends money in the present, and the prices of goods and services may go up by the time one is.

Chime Credit Card Spending Limit

The maximum upper limit on purchases for the Chime credit builder card is $7, per day. That's more than enough for most users. Credit Utilization and Your. Your credit limit is the most you can spend, not the recommended amount. Unless you have no other choice, you should only spend what you can afford to pay off. Credit Builder doesn't have a pre-set credit limit. Instead, the money you move into your Credit Builder secured account sets your spending limit on the card. The Secured Chime Credit Builder Visa® Credit Card is a secured credit card with a credit limit that can go as high as $10, Your limit is based on what you. I have the Chime Credit Builder card. I am trying to understand what my credit limit is, however the Chime app only tells me what is available to spend. The highest limit I have ever had is still in effect on one of my cards at $, There are a couple of $80k's and $70k's, but most are. The balance in your Chime Credit Builder account determines the credit limit on your Chime Credit Builder card. So if you have $ in your account, you can. Chime. Coast Pay. Credit One Bank. Edenred Set individual spending limits for greater control. Round-the-clock monitoring for unusual credit card purchases. Transfer money to your Chime Credit Builder secured account: Your credit limit is determined by the security deposit you put into your secured account. Use your. The maximum upper limit on purchases for the Chime credit builder card is $7, per day. That's more than enough for most users. Credit Utilization and Your. Your credit limit is the most you can spend, not the recommended amount. Unless you have no other choice, you should only spend what you can afford to pay off. Credit Builder doesn't have a pre-set credit limit. Instead, the money you move into your Credit Builder secured account sets your spending limit on the card. The Secured Chime Credit Builder Visa® Credit Card is a secured credit card with a credit limit that can go as high as $10, Your limit is based on what you. I have the Chime Credit Builder card. I am trying to understand what my credit limit is, however the Chime app only tells me what is available to spend. The highest limit I have ever had is still in effect on one of my cards at $, There are a couple of $80k's and $70k's, but most are. The balance in your Chime Credit Builder account determines the credit limit on your Chime Credit Builder card. So if you have $ in your account, you can. Chime. Coast Pay. Credit One Bank. Edenred Set individual spending limits for greater control. Round-the-clock monitoring for unusual credit card purchases. Transfer money to your Chime Credit Builder secured account: Your credit limit is determined by the security deposit you put into your secured account. Use your.

Instead, your credit limit is the total balance you've deposited into the secured account, and since you can only spend the money you have, you'll avoid an APR. It functions more like a secured charge card, meaning you can't carry a balance and have spending restrictions compared to traditional credit. They may change it if you put more money into the account. If you withdraw funds, your credit limit will drop. Here's your best strategy: Use. Mobile banking done better. Build credit while you bank. No overdraft fees/hidden fees. Current is a fintech not a bank. Banking services provided by Choice. You get to set your own limit by moving any amount to and from your Credit Builder secured account whenever you want. When you make a purchase, a hold is placed. You get to set your own limit by moving any amount to and from your Credit Builder secured account whenever you want. When you make a purchase, a hold is placed. You can use your credit limit to make purchases, and you will need to pay your balance in full each month. As you make on-time payments and keep. Many virtual debit cards allow users to set a maximum spend or charge limit on the card to prevent the account from being overcharged. The Chime Visa® Debit. The daily ATM cash withdrawal limit is $ Note: the Gusto debit card does not support ATM cash deposits. Annual Percentage Yield (APY) and monthly statements. To me that's like saying you got control over your credit limit basically. Also I love the fact I only have to spend about $90 once a year for the credit card. It functions more like a secured charge card, meaning you can't carry a balance and have spending restrictions compared to traditional credit. The Chime Credit Builder Card allows you to deposit up to $10, and then spend it as you see fit. This secured Visa card comes with many helpful features. Traditional credit cards have a fixed credit limit, but this card doesn't. The money you move into your credit builder secured account sets your spending. Most secured credit cards require a minimum security deposit of around $ when you open your account. This deposit doubles as your credit limit and is held as. Many virtual debit cards allow users to set a maximum spend or charge limit on the card to prevent the account from being overcharged. The Chime Visa® Debit. Unlike many traditional credit cards, the Secured Chime Credit Builder Visa® Credit Card doesn't have a preset spending limit. Instead, the amount you're able. *Money added to Credit Builder will be held in a secured account as collateral for your Credit Builder Visa card, which means you can spend up to this amount on. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. To increase that limit to $, you need to show good history with any Chime-branded account, direct deposit history (frequency and amounts), and spending. corresponding reductions in spending limits. See, e.g., Chime, How it works, 88rajaslothoki.ru · builder/ (last accessed July 18, ). Page

Where Is The Best Place To Invest 10000 Dollars

Fundrise. $ minimum investment; 1% management fee; equity and debt investments; average return of % from to ; dividend payments vary depending. An IRA account helps you save part of your earnings while enjoying tax advantages. This way, you can start saving for retirement in the coming years. Roth IRA. 5 ways to invest $10, · 1. Build your emergency savings fund · 2. Pay off high-interest loans · 3. Fund your retirement account · 4. Invest in an index fund · 5. The Goldman Sachs Group, Inc. is a leading global investment banking, securities, and asset and wealth management firm that provides a wide range of. Mutual funds; Exchange-traded funds; CDs; Real estate investment trusts; Money market accounts; Roth IRAs; High-yield savings accounts; Brokerage accounts. How To Invest $10, Wisely: 8 Best Ways · 1. Contribute to a (k) or an IRA · 2. Contribute to an HSA · 3. Invest In Real Estate · 4. Buy Series I Savings Bonds. Where The Pros Would Invest $10, Right Now · Mentioned in story · NVDA · NVIDIA Corp · LQD · iShares iBoxx USD Investment Grade Corporate Bond ETF · MSFT. High-yield savings account: A high-yield savings account works in the same way as a traditional savings account. It's a deposit account at a credit union or. Whether you've won the lottery or received an inheritance, $10, is a significant amount of money. So, what should you do with it? Save it. Invest it. Fundrise. $ minimum investment; 1% management fee; equity and debt investments; average return of % from to ; dividend payments vary depending. An IRA account helps you save part of your earnings while enjoying tax advantages. This way, you can start saving for retirement in the coming years. Roth IRA. 5 ways to invest $10, · 1. Build your emergency savings fund · 2. Pay off high-interest loans · 3. Fund your retirement account · 4. Invest in an index fund · 5. The Goldman Sachs Group, Inc. is a leading global investment banking, securities, and asset and wealth management firm that provides a wide range of. Mutual funds; Exchange-traded funds; CDs; Real estate investment trusts; Money market accounts; Roth IRAs; High-yield savings accounts; Brokerage accounts. How To Invest $10, Wisely: 8 Best Ways · 1. Contribute to a (k) or an IRA · 2. Contribute to an HSA · 3. Invest In Real Estate · 4. Buy Series I Savings Bonds. Where The Pros Would Invest $10, Right Now · Mentioned in story · NVDA · NVIDIA Corp · LQD · iShares iBoxx USD Investment Grade Corporate Bond ETF · MSFT. High-yield savings account: A high-yield savings account works in the same way as a traditional savings account. It's a deposit account at a credit union or. Whether you've won the lottery or received an inheritance, $10, is a significant amount of money. So, what should you do with it? Save it. Invest it.

The real estate market is not the only place where income is increased for investors. This best way to invest $10, guide is meant for investors who are ready. If you put chunks of money in certificates of deposit with varying term lengths, you can reinvest money each year as the CDs mature and capture the latest. Saving helps you put money aside for important needs, whereas an investment investment options to best meet your needs. Types of investments. Edward. Mix stocks and bond and potentially real estate. For stocks, do not buy individual stocks. Choose a fund (like an ETF) with low fees that. Mix stocks and bond and potentially real estate. For stocks, do not buy individual stocks. Choose a fund (like an ETF) with low fees that. 5 ways to invest $10, · 1. Build your emergency savings fund · 2. Pay off high-interest loans · 3. Fund your retirement account · 4. Invest in an index fund · 5. In any one calendar year, you may buy up to $10, in Series EE Another way to buy savings bonds is to have your employer send money from. Consider investing in index funds that mirror major stock indexes, such as the S&P or Russell These funds have low expense ratios (fees) and give you. High-yield accounts have become one of my favorite investments right now. They are low-risk, easy to open, and I can withdraw my money at any time if I need it. Even if you start with less than $10k, spreading your money among different types of investments can be a good way to reduce risk and build a strong. With that, you could expect your $10, investment to grow to $34, in 20 years. Why Is the S&P a Good Long-Term Investment? The S&P is one of the. “For a smaller investment I would typically recommend a product like mutual funds or exchange-traded funds (ETFs) that construct and manage a range of. Best Way to Invest $10, · 1. Investing in Mutual Funds · 2. Investing in Exchange-Traded Funds · 3. Investing in Stocks · 4. Investing in Options · 5. Investing. I didn't buy stocks, crypto or real estate. I took my $10, and invested it into my own skillsets and into my business. Here's the. Finally, one other way that you could invest those $10, dollars is to really find a great investment like I will talk about later, like dividend growth. You can also invest in an opportunity fund, which is a great way to invest $10, in the short term. Save for larger investments like a down payment on rental. Growth of 10K (or growth of 10,) is a commonly used chart that highlights the change in value of an initial $10, investment in a financial asset. Top-up & invest your way. Get started with as little as £1 and get your portfolio working for you. Buy stocks and ETFs with Wealthyhood fractional shares. ETFs. Exchange-traded funds (ETFs) can be one of the best ways for beginners to invest. With one single, often cheap, investment. Bond investing is a great way to diversify your portfolio, as bonds provide a steady stream of income and are often less risky than stocks. Bonds are debt.